The number of UK exporters increased slightly in May 2022, according to the latest Exporter Monitor by Coriolis Technologies and the Institute of Export & International Trade (IOE&IT).

However, this overall growth masks a revenue crisis for micro, small and medium-sized exporters.

SMEs struggle

Our data suggest that in May 2022 the number of companies exporting from the UK increased by 1%, employment in UK exporting firms by 4% and revenues over all by 3%.

However, this increase in revenues was accounted for entirely by higher revenues for the largest businesses.

It obscures the fact that micro, small and medium-sized companies all showed drops in revenues compared to last month, of 4%, 6% and 1% respectively.

Cost of living crisis

Last month’s drop in exporter employment and revenues appears, as predicted, to have transferred into the supply chains where smaller and more vulnerable businesses are more prevalent.

As the cost-of-living rises, and as exporter revenues decline amongst the nation’s smallest businesses, this will inevitably impact a number of small businesses and how many people they employ.

The outlook suggests that this increase will soften into June, given the weaker revenues and an overall pattern over the course of the last year of declining exporter numbers, exporter revenues and exporter employment. It also suggests that the full effects of the pandemic, the Russia-Ukraine crisis and Brexit still have to work through the UK trade system.

Coriolis Technologies Chief Executive, Dr Rebecca Harding said:

“The data suggest that the long-term viability of UK-originating supply chains is under threat from a decline in revenues amongst smaller exporting businesses. Compared to June 2021 revenues are on average nearly 5% lower with smaller businesses particularly severely hit.

"The consequences of this for jobs and for the future of UK PLC cannot be understated and the fragility of the UK export sector needs to be acknowledged if we are to find practical solutions and restore trade’s role in contributing to GDP.”

Institute of Export & International Trade Director General, Marco Forgione said:

“This ongoing trend is concerning. It is clear that a lot of work needs to be done to help smaller businesses through this turbulent trading period.

"The increased cost of energy, fuel and disruption to the global supply chain is having a much greater impact on UK MSMEs. These revenue hits will have significant long-term impacts as they reduce investment, innovation and development. It is important that smaller companies are offered the training and guidance to navigate through this period and we stand ready to support them through this.

"This decline has a cumulative impact because while UK businesses withdraw from markets and fail to invest, their overseas competitors are taking advantage. UK exporters are a vital part of our economy and if the government wants to meet its ambitious export target of £1tn more must be done to create a fertile environment where trade can flourish.”

The findings in detail

Figure 1: Counts of Exporters over time, May 2020- May 2022

NOTE: The data for England, Scotland, Wales and Northern Ireland are given in the Appendix

Exporter counts across the UK increased by 1.10% since last month, bringing the UK total to 63,401. Wales saw an increase of 2.25% with 23 more exporter counts and England, 1.16% with 677 more. Scotland’s exporter counts fell by 0.17% with 5 fewer exporters and Northern Ireland’s by 0.71%, with 4 fewer.

Figure 2: Exporter employment over time, May 2020- May 2022

NOTE: The data for England, Scotland, Wales and Northern Ireland are given in the Appendix

Exporter employment across the UK grew by 3.56% this month. England outperformed the UK average with an increase of 3.82%, followed by an increase of 2.57% in Northern Ireland. Scotland’s exporter employment fell by 0.17% and Wales experienced a 0.62% decline. This brings total figures across the UK up to 13,846,174 – a 476,209 increase since last month, constituted by 472,281 more employees in England, 3,929 more in Northern Ireland, 1124 fewer in Scotland, and 1123 fewer in Wales.

It should be noted that the employment figures correlate to the number of exporting companies. This means that employment increases when new companies start exporting, and employment decreases when companies stop exporting.

Figure 3: Exporter revenues over time, May 2020-May 2022

NOTE: The data for England, Scotland, Wales and Northern Ireland are given in the Appendix

Overall, there has been a 3.44% increase in exporter revenues since last month, comprising a growth of 7.42% in Wales, 3.92% in England, 2% in Northern Ireland, and a decline of 6.06% in Scotland. This means that the UK increased its revenue by £178.23m since last month.

Since May 2021, there has been a decline in revenue of 3.03% across the UK, a total of £167.61m. Compared to May last year, there has been a £111.46m decline for England, £40.36m fall for Scotland, £0.73m drop for Northern Ireland, and a £4.8m decline for Wales.

Figure 4: Monthly and annual changes in numbers of exporters (%)

The overall numbers of large, medium, small, and micro exporters across the UK rose by 0.91%, 0.41%, 0.46%, and 2.15% respectively since last month, equating to a 1.10% increase in exporter counts overall. In comparison to May 2021, large, medium, small, and micro companies have seen a decline in exporter counts of 0.64%, 4.19%, 4.5%, and 5.64%, with an overall year on year drop of 4.59%.

Figure 5: Monthly and annual changes in exporter employment (%)

All sizes of companies across the UK increased their employment since April 2022, with growth of 4.33% in large companies, 2.33% in micro companies, 0.53% in small companies, and 0.43% in medium companies. This is an increase of 3.69% since last month.

However, May 2022 compared to May 2021 shows a decrease in employment across all sized companies: -7.81% in large companies, -4.65% in medium companies, -4.23% in small companies, and -4.75% in micro companies, totalling a fall of -7.29%.

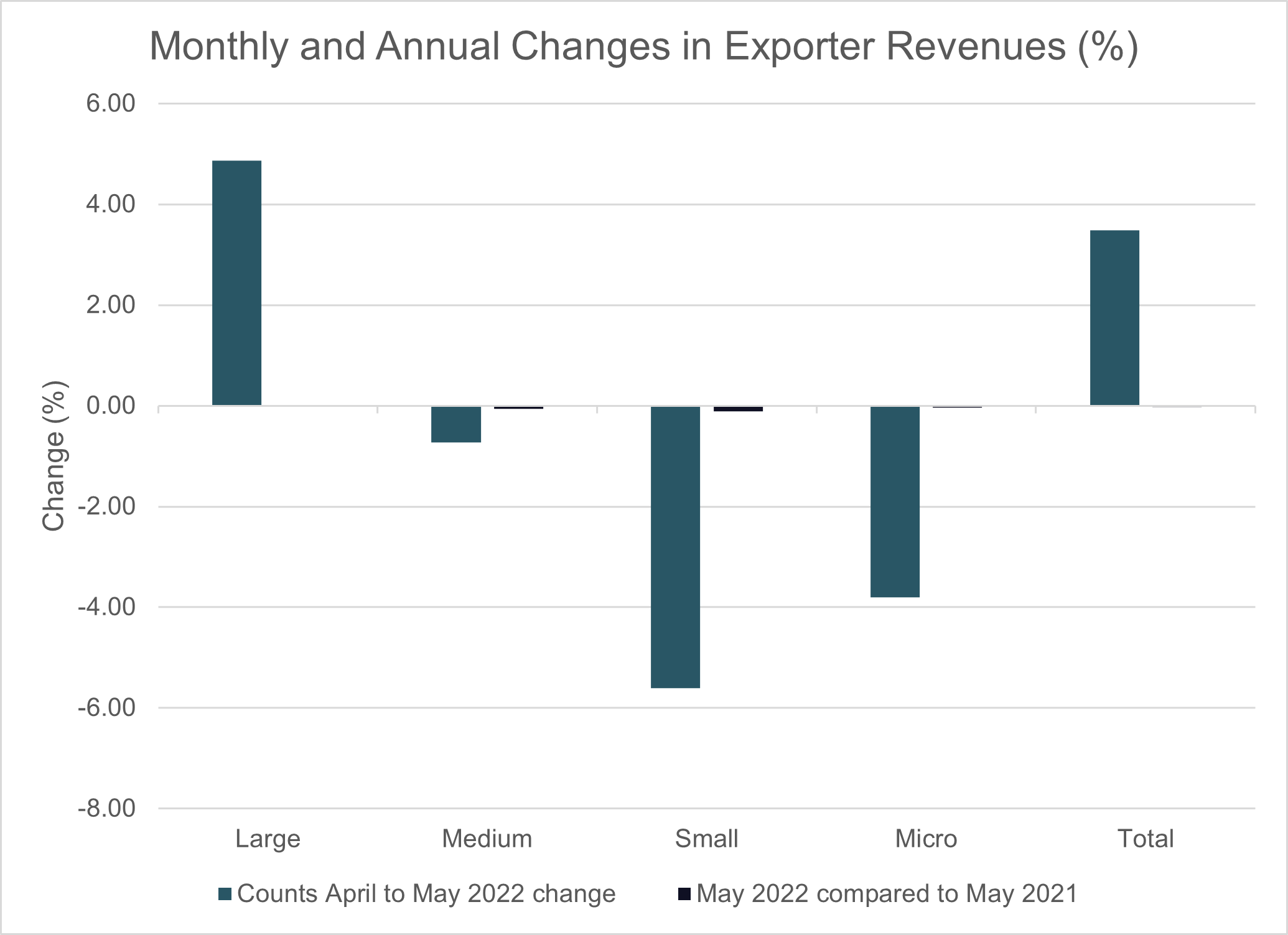

Figure 6: Monthly and annual changes in exporter revenues (%)

Total exporter revenues have increased since last month, principally driven by large companies who saw a 4.87% growth. Micro companies felt the biggest drop in revenues at -5.61%, followed by small companies with -3.81% and medium sized companies with -0.72%.

Compared to May 2021, all sizes of companies had a decline in revenues: -1.31% for large companies, -5.98% for medium companies, -3.85% for small companies, and -10.73% for micro companies.

>Against these measurements, micro companies have been hit the most since both last month and last year, whilst large companies have fared the best in both the year-on-year comparison, having the smallest annual revenue drop, and the monthly comparison, being the only company size to increase their revenues since last month.

In line with our predictions last month, despite the overall uptick, we expect to see a decline next month in exporter counts and revenue. We will potentially see an uptick in employment next month but if this does transpire, it will be short-lived and July and August will see a decline as a result.

About Coriolis Technologies

Founded in 2017, Coriolis Technologies is the leading source of trade, corporate, geopolitical risk and trade-related economic data globally for the trade finance sector. Coriolis Technologies provides clear intelligence and insight into trade flows, supply chains and disruptions for trade and trade finance.

About The Institute of Export & International Trade

The Institute was established over 85 years ago to support UK businesses in growing their international markets and trade. The Institute is the leading association of exporters and importers providing education and training to professionalise the UK’s international traders.

You can view the full release, including the methodology and press contacts, here.