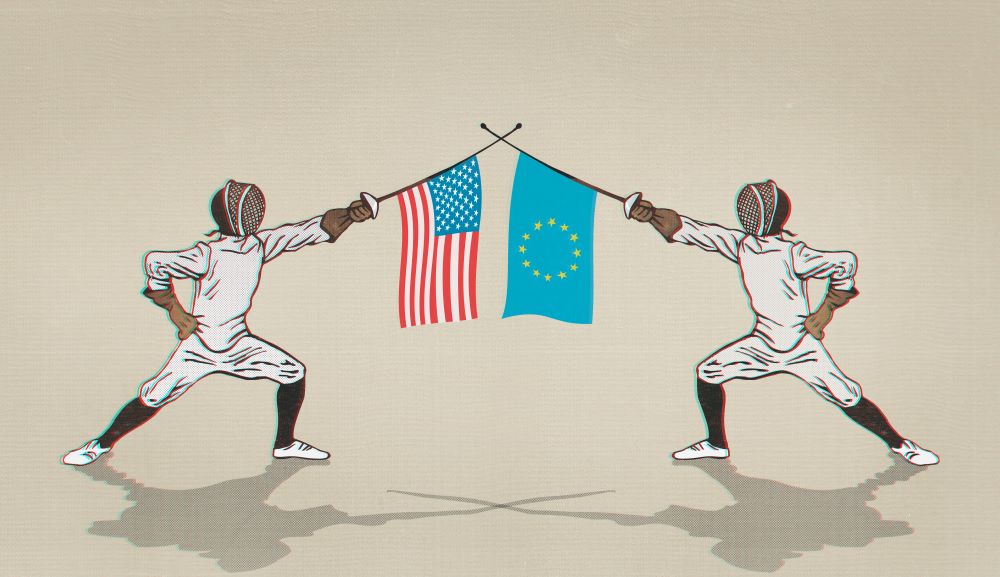

The EU and US remain deadlocked in trade talks on steel and electric vehicles (EVs), despite early hopes that a deal would be reached on Friday (20 October).

US president Joe Biden hosted European Commission (EC) president Ursula von der Leyen and EU Council president Charles Michel for three-way talks, a meeting many hoped would herald new agreements.

However, a joint EU-US statement from merely “confirmed continuing to make progress” on a steel agreement.

Hopes

Reuters reported that hopes were not high that a deal would come out of the talks, as conflicts in Ukraine and the middle east both appeared to be the priority.

EU diplomats were hoping to secure subsidies from the US Inflation Reduction Act for European car manufacturers and an agreement eliminating Trump-era steel and aluminium tariffs.

Representatives from the US and EU are still optimistic about reaching a deal to eliminate steel and aluminium tariffs imposed by former president Donald Trump, Bloomberg reports.

Tariff regime

Trump’s administration imposed tariffs in 2018, citing national security concerns, which led to a deterioration in EU-US relations.

A suspension of those tariffs in October 2021 eased tensions but that reprieve is coming to an end, with officials given an extended deadline of 1 January 2024 to reach a new agreement.

Speaking to Reuters from Spain last week, French trade minister Oliver Becht said the failure of October talks was “clearly a disappointment”.

He added:

“The discussions were intense and I hope they will restart as soon as possible."

Speaking to Politico Europe, US trade representative Katherine Tai described the two powers as “star-crossed lovers” and lamented their inability to “cross the line” on trade deals.

Global steel club

Alongside attempts to resolve historic tariffs is the pair’s ambition to forge a bloc of steel trading nations.

The Global Arrangement on Sustainable Steel and Aluminium (GSA) would see the US, EU and other members impose 25% tariffs on steel and 10% tariffs on aluminium imports from countries with non-market economies.

Despite being proposed as a way of decarbonising the metal industry in 2022, the six criteria for entry into the so-called “steel club” have been interpreted as retaliatory action against China.

China placed export controls on critical minerals such as geranium and gallium in August and graphite on Friday.

Commentators suspect the GSA could attract the World Trade Organization’s (WTO) attention for contravening rules on free trade.

Sharing those concerns, the EU has pushed to hold off on implementing GSA tariffs until an investigation confirms the arrangement adheres to WTO rules.

Mineral misfire

Critical mineral measures also contributed to EU–US trade deal disappointment, as a proposed deal on EVs offering EU manufacturers access to Inflation Reduction Act subsidies also stalled, the FT reports.

Under the legislation, signed into law by Biden in August 2022, almost US$400bn of tax credits were released to incentivise investment in US industry, particularly green energy. A further round of legislation in February offers similar incentives for EVs.

Another source of transatlantic tension, Biden’s industrial policy has been heavily criticised by the EU for disadvantaging members exporting to the US and redirecting investment.

To qualify for EV subsidies, firms must evidence that critical minerals used in their EV batteries are produced or processed in the US, or a country with which the US has a critical minerals agreement (CMA).

The EU approached talks seeking a CMA but didn’t meet stringent US requirements on worker rights and environmental protections.