Over a quarter of UK traders have said they would not feel prepared for a customs audit from HMRC were one to happen in their business tomorrow, a new poll has found.

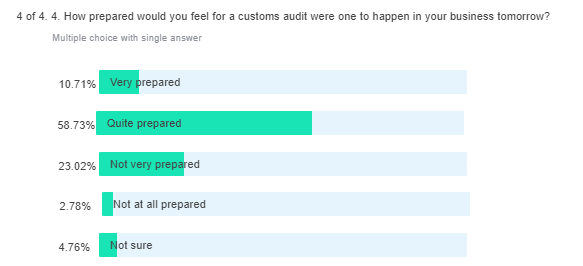

On an IOE&IT webinar yesterday (30 March) focussing on firms’ customs compliance requirements following the submission of a declaration, 23% of attendees said they were ‘not very prepared’ and 3% ‘not at all prepared’ for an official inspection.

Awareness

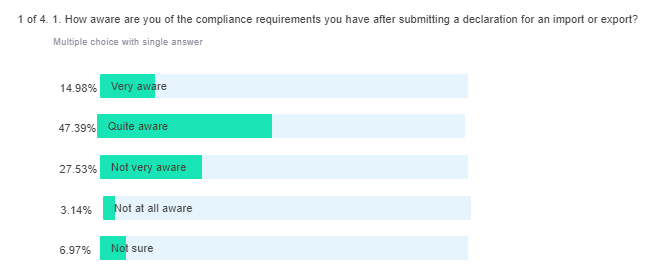

Just under a third (31%) of businesses on the webinar said they were either ‘not very aware’ or ‘not at all aware’ of their post-declaration compliance requirements. The majority (62%) said they were aware of their obligations.

“We’ve seen in the 18 few months a lot of communications about new customs processes and opportunities to streamline these processes, following the departure from the EU,” said IOE&IT customs and trade specialist Rob Booth on the webinar.

“Firms now very need to embrace these new compliance obligations,” he added.

The maximum penalty for non-compliance is a fine of up to £2,500.

Record keeping

Although firms are already required to complete customs declarations for imports and exports, many are now learning that they are required to keep evidence relating to their goods movements for several years after they’ve taken place.

For zero rating VAT on exports, evidence proving that the goods have left the UK must be kept for a period of up to six years.

For imports, evidence is required to show that the right amount of duty has been calculated and paid, or that the origin of the goods has been sufficiently proven if claiming a preferential duty rate.

Customs special procedures

There are also further documentary requirements around licences and certificates, as well as additional compliance obligations if firms are using customs special procedures to streamline their processes at the point at which goods cross the border.

Records related to these procedures must be kept for at least four years.

Free Webinar

The IOE&IT will be hosting a follow-up to yesterday’s webinar on 25 April addressing how firms can prepare for a customs audit.

It will cover:

- The documentary evidence you need to keep

- What HMRC looks for when conducting an audit

- What happens during an audit

- What happens after

- How to prepare for one

You can sign up to the free webinar here.